We live in taxing times, and don’t expect the new government to alter most of what follows

09 Jul 2024

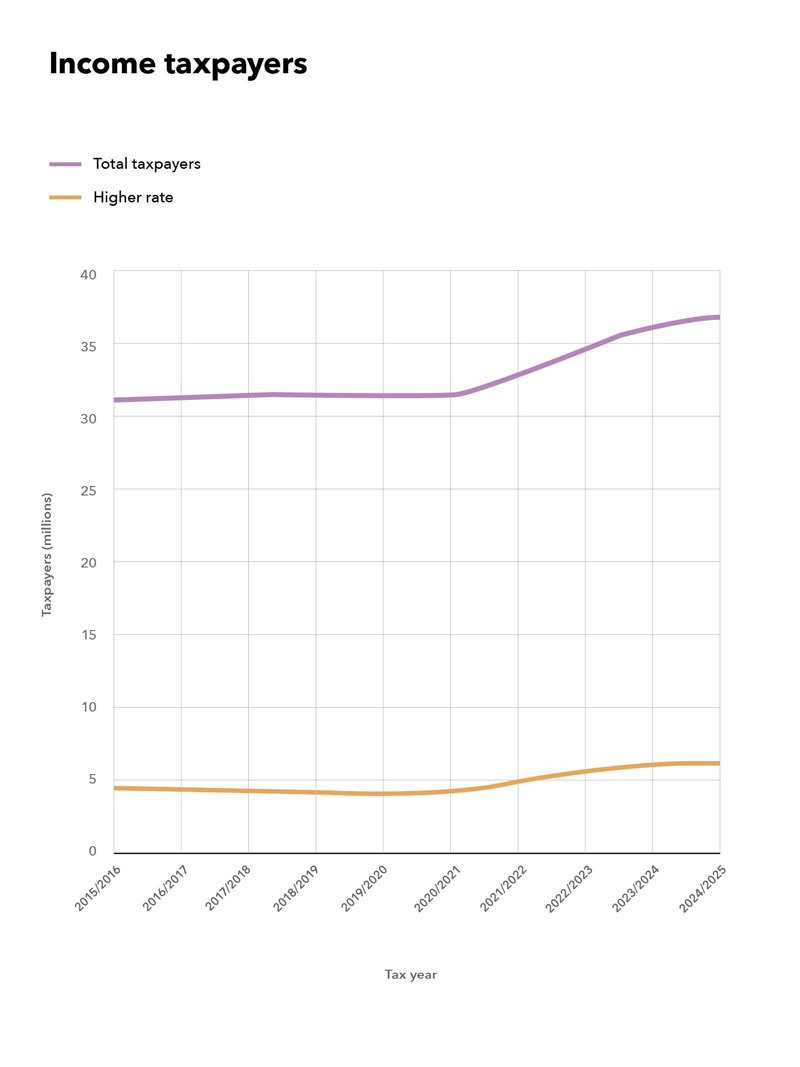

HMRC estimates that 37.4m people will pay income tax in 2024/25, up by 1.2m on 2023/24 and 4.4m on 2021/22, when the tax-free personal allowance was frozen.

HMRC's latest figures for the number of taxpayers for 2024/25 are broken down by age, sex and marginal rate of income tax (basic rate, higher rate and additional rate).

Broadly, a person pays income tax when their income for the year exceeds the personal allowance (£12,570 for 2024/25). A person's marginal rate is the rate of income tax that an extra £1 of income would be taxed at. Scottish taxpayers are included according to the marginal rate that corresponds to the basic, higher or additional rate.

Key figures

The total number of taxpayers for 2024/25 is expected to increase by approximately 3.3% compared with 2023/24, and by 13.3% compared with 2021/22.

It is estimated that in 2024/25 the marginal rate will be the basic rate for 29.5m taxpayers, higher rate for 6.3m taxpayers, and additional rate for 1.1m taxpayers. There has been a 5.2% increase compared to 2023/24, and a 42.4% increase compared to 2021/22, for taxpayers in the higher rate category. 2024/25 will be the first year in which the number of additional rate taxpayers has exceeded 1m.

Since 2021/22, the personal allowance has been frozen at £12,570, and the threshold at which individuals start paying income tax at the higher rate in England, Wales and Northern Ireland has been frozen at £37,700 (£50,270 including the personal allowance).

The second payment on account towards income tax self assessment (ITSA) liabilities and class 4 national insurance contributions (NIC) for 2023/24 is due by 31 July 2024.

Although the due date for paying ITSA and class 4 NIC for 2023/24 is 31 January 2025, some taxpayers are required to make payments on account. The first payment was due on 31 January 2024 and the second is payable on or before 31 July 2024. The amounts are calculated according to the person's liabilities for 2022/23.

ICAEW is warning taxpayers to prepare for the 31 July 2024 payment deadline. Missing the deadline could prove to be expensive as HMRC's interest rate for late payments is currently 7.75%.

As the amounts are based on the previous year's figures, too much tax may be paid if the person's total ITSA and class 4 NIC liability is lower than their liability for 2022/23 (eg, because their business profits have fallen). In this case, it may be possible to reduce the payment on account due on 31 July 2024 by either submitting the return for 2023/24 or making a claim.

What are payments on account?

A person is required to make a payment on account for 2023/24 unless:

- their total ITSA and class 4 NIC liability for 2022/23 was less than £1,000; or

- more than 80% of the income tax and NIC they owed for 2022/23 was deducted at source (eg, through pay as you earn).

Each payment on account is equal to 50% of the person's total ITSA and class 4 NIC liability for 2022/23. If the final tax liability exceeds the payments on account made, a balancing payment is due by 31 January 2025.

Applying to reduce the 31 July payment on account

Payments on account for 2023/24 are reduced where the person's total ITSA and class 4 NIC liability for 2023/24 is less than that for 2022/23. The reduction is made when the person submits their ITSA return for 2023/24 to HMRC. In other words, the amount due by 31 July 2024 could be reduced if the person submits their tax return for 2023/24 in advance of that date.

Where the person does not expect to submit their 2023/24 return by 31 July 2024, and they believe that their total ITSA and class 4 NIC liability for that year will be lower than that for 2022/23, they can apply to HMRC to reduce their payment on account.

The taxpayer can do this online or by completing the form, printing it and then posting it to HMRC. The taxpayer's agent can make the claim on the taxpayer's behalf through their HMRC account.

Care should be taken to ensure that it is appropriate to make a claim. HMRC may charge a penalty where a taxpayer fraudulently or negligently makes an incorrect statement in a claim to reduce a payment on account. The maximum penalty is the difference between the payment that should have been made and the amount that was paid.

We are obliged to the ICAEW for putting these figures together, and what they mean is more work for an already stretched HMRC. In a recent report, the National Audit Office found that taxpayers spent the equivalent of 798 years waiting on HMRC helplines in 2022/23, and we've commented on that more than once.. This can only get worse as frozen allowances and thresholds drag more people into the tax system, and more people have to deal with complex tax rules. It remains to be seen whether the additional funding of £51m for HMRC announced in May will be enough to help HMRC improve its services to taxpayers.